Crafting Your Perfect Investment Mix

When it comes to building a well-balanced investment portfolio for optimal returns, one of the most crucial steps is crafting your perfect investment mix. This involves carefully selecting a combination of assets that will work together to help you achieve your financial goals while minimizing risk.

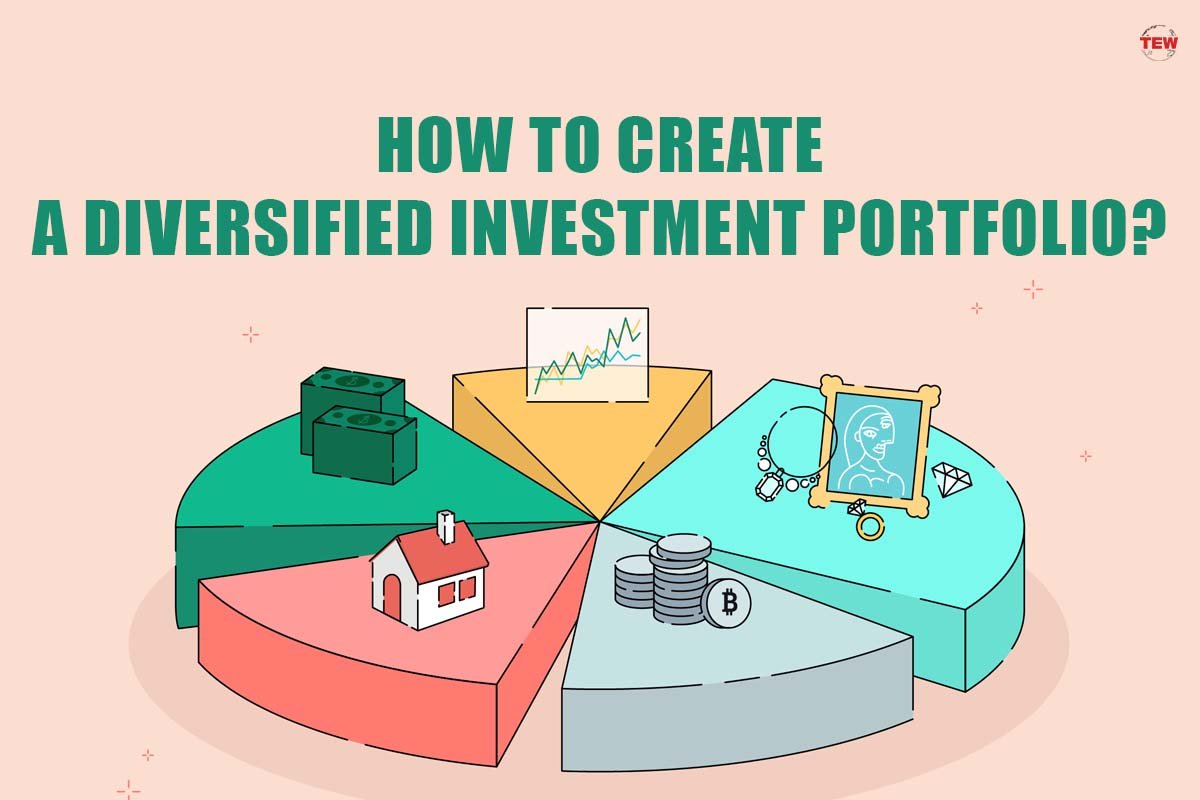

The key to crafting a perfect investment mix is diversification. By spreading your investments across different asset classes, industries, and regions, you can reduce the impact of market fluctuations on your portfolio. This means that if one asset performs poorly, the others can help to offset those losses.

To start crafting your perfect investment mix, you first need to assess your financial goals and risk tolerance. Are you looking to grow your wealth over the long term, or are you more interested in preserving your capital? Understanding your goals will help you determine the right mix of assets for your portfolio.

Next, consider the different asset classes available to you. These can include stocks, bonds, real estate, commodities, and cash. Each asset class has its own risk and return characteristics, so it’s important to choose a mix that aligns with your goals and risk tolerance.

Image Source: theenterpriseworld.com

Once you’ve selected the asset classes you want to include in your portfolio, you can further diversify by choosing investments within each class that have different risk profiles. For example, within the stock portion of your portfolio, you could invest in a mix of large-cap, mid-cap, and small-cap companies to spread out your risk.

It’s also important to consider the correlation between your chosen assets. Ideally, you want to select investments that don’t move in the same direction at the same time. This means that when one asset is performing poorly, another may be performing well, helping to balance out your overall returns.

Rebalancing your portfolio regularly is another key aspect of crafting your perfect investment mix. Over time, the performance of your assets will vary, causing your portfolio to drift away from its original allocation. By rebalancing, you can bring your portfolio back in line with your target mix, ensuring that you maintain the desired level of diversification.

In conclusion, crafting your perfect investment mix is a crucial step in building a well-balanced investment portfolio for optimal returns. By diversifying across different asset classes, industries, and regions, and regularly rebalancing your portfolio, you can help to minimize risk and maximize returns over the long term. So take the time to carefully craft your investment mix and watch as your portfolio grows and prospers.

Building a Well-Balanced Investment Portfolio for Optimal Returns

Maximizing Returns with Diverse Assets

When it comes to building a well-balanced investment portfolio for optimal returns, one of the key strategies is to maximize returns with diverse assets. Diversification is a vital component of any successful investment strategy, as it helps to spread risk and maximize potential returns. By investing in a variety of assets, you can reduce the impact of market fluctuations on your portfolio and increase your chances of achieving your financial goals.

Diversifying your investments can take many forms, including investing in different asset classes such as stocks, bonds, real estate, and commodities. Each asset class has its own unique risk and return characteristics, so by spreading your investments across multiple asset classes, you can reduce the overall risk of your portfolio while potentially increasing your returns.

Another way to maximize returns with diverse assets is to invest in a mix of both domestic and international securities. By investing in international markets, you can gain exposure to different economies and industries, which can help to further diversify your portfolio and potentially increase your returns. International investing also allows you to take advantage of opportunities that may not be available in your home country, providing you with additional sources of potential return.

In addition to investing in different asset classes and markets, you can also diversify your investments by incorporating alternative assets into your portfolio. Alternative investments, such as hedge funds, private equity, and real assets like precious metals and collectibles, can provide unique sources of return that are not correlated with traditional investments. By including alternative assets in your portfolio, you can further reduce risk and potentially enhance returns.

When it comes to maximizing returns with diverse assets, it’s important to remember that diversification alone is not enough. You also need to carefully consider the correlation between your investments, as well as your overall risk tolerance and investment goals. By carefully crafting a well-balanced investment mix that takes into account these factors, you can build a portfolio that is optimized for both risk and return.

Ultimately, the key to building a well-balanced investment portfolio for optimal returns is to diversify your assets across different classes, markets, and investment strategies. By incorporating a variety of assets into your portfolio, you can reduce risk, increase potential returns, and achieve your financial goals with confidence. So don’t be afraid to think outside the box and explore the possibilities of diverse assets in your investment strategy. Your portfolio will thank you for it.

How to Create a Diversified Investment Portfolio for Maximum Returns