Unveiling the Hottest Investment Trends for 2022

As we step into a new year, it’s essential for investors to keep their eyes peeled for the latest trends in the market. Staying ahead of the game can make all the difference when it comes to maximizing your returns and minimizing your risks. In this article, we will delve into some of the hottest investment trends for 2022 that are worth keeping an eye on.

1. ESG Investing: Environmental, Social, and Governance (ESG) investing has been gaining traction in recent years, and this trend is expected to continue in 2022. Investors are increasingly looking to put their money into companies that prioritize sustainability, social responsibility, and good governance practices. As climate change and social issues become more pressing concerns, companies that are ESG-focused are likely to outperform their peers.

2. Tech Stocks: The tech sector has been a top performer for several years now, and there’s no sign of that changing in 2022. With advancements in artificial intelligence, cloud computing, and other emerging technologies, tech companies continue to drive innovation and disrupt traditional industries. Investing in tech stocks can offer investors growth potential and exposure to cutting-edge developments.

3. Healthcare Innovation: The healthcare sector is ripe for innovation, with new technologies and treatments constantly being developed. From telemedicine to personalized medicine, there are plenty of opportunities for investors to capitalize on the latest advancements in healthcare. Companies that are at the forefront of these innovations could see significant growth in the coming year.

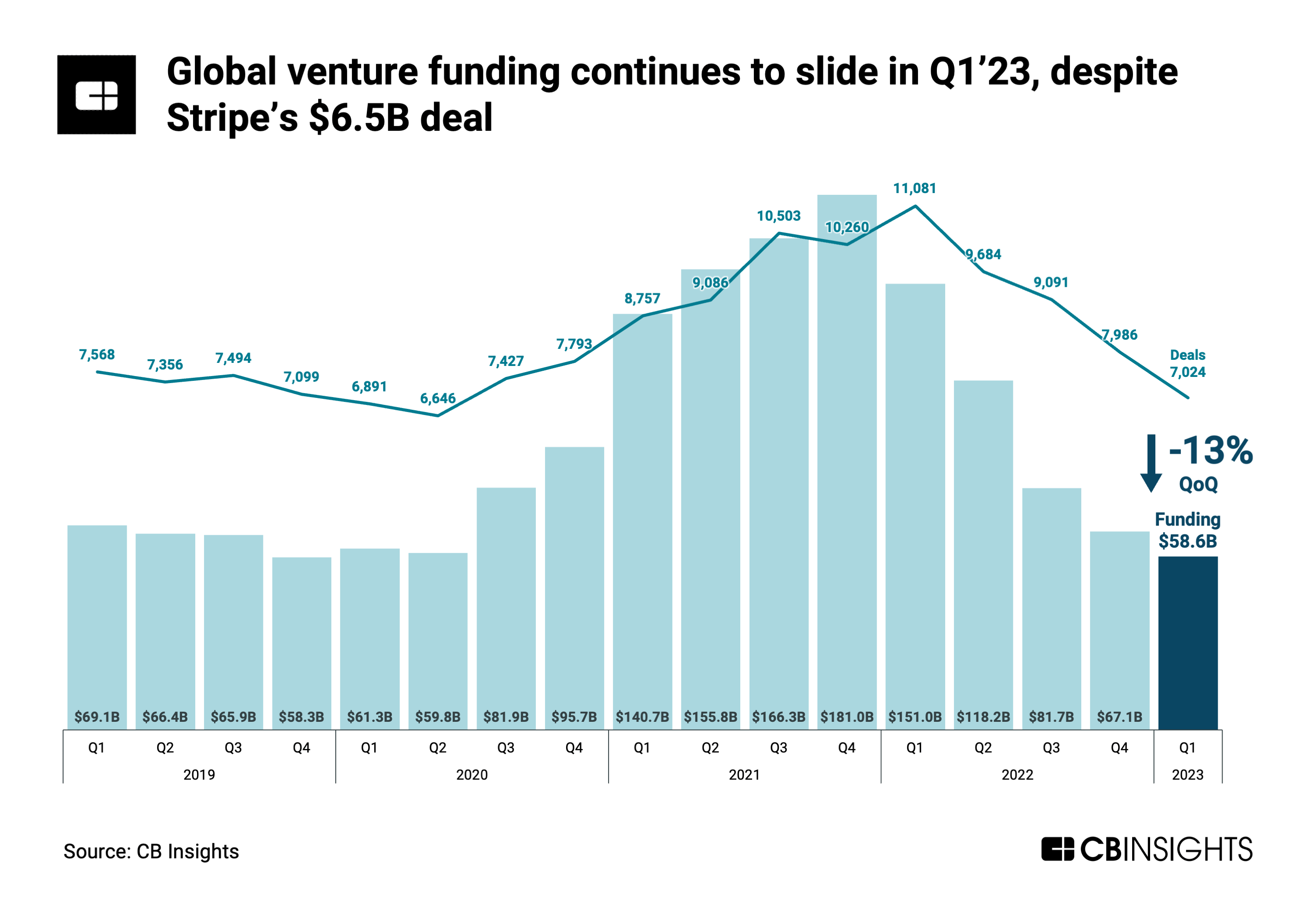

Image Source: cbinsights.com

4. Cryptocurrency and Blockchain: Cryptocurrencies like Bitcoin and Ethereum have been making headlines in recent years, and the blockchain technology that underpins them has the potential to revolutionize various industries. As more institutional investors get on board with cryptocurrencies and blockchain applications, these assets could see continued growth and mainstream adoption in 2022.

5. Sustainable Energy: With the push for renewable energy sources and the transition away from fossil fuels, the sustainable energy sector is poised for significant growth in 2022. Investing in companies that are involved in solar, wind, or battery technology could prove to be lucrative as the world shifts towards a more sustainable future.

6. Real Estate: The real estate market has been booming in many parts of the world, driven by low-interest rates and high demand for housing. As cities continue to grow and urbanization trends persist, investing in real estate can offer investors a stable source of income and potential capital appreciation. From residential properties to commercial developments, there are plenty of opportunities to explore in the real estate market.

7. Emerging Markets: As the global economy continues to recover from the impacts of the pandemic, emerging markets are expected to play a significant role in driving growth. Investing in emerging market equities or bonds can provide investors with diversification benefits and exposure to economies that are poised for rapid expansion. With increasing globalization and interconnectedness, keeping an eye on emerging markets could offer attractive investment opportunities in 2022.

In conclusion, keeping an eye on the top investment trends for the year ahead is crucial for investors looking to capitalize on emerging opportunities and stay ahead of the curve. By staying informed and proactive, investors can position themselves for success in a rapidly evolving market environment. Whether it’s ESG investing, tech stocks, healthcare innovation, or other emerging trends, there are plenty of exciting opportunities to explore in 2022. So, buckle up and get ready to ride the wave of the hottest investment trends this year!

Stay Ahead of the Game with These Top Investment Trends

As we enter a new year, it’s important for investors to stay ahead of the game by keeping an eye on the top investment trends for the year ahead. With the ever-changing landscape of the global economy, it’s crucial to be aware of where the smart money is going and what sectors are poised for growth. Here are some key investment trends to watch out for in 2022.

1. ESG Investing: Environmental, Social, and Governance (ESG) investing has been gaining traction in recent years as more investors are looking to put their money into companies that are committed to sustainability and social responsibility. With climate change becoming an increasingly urgent issue, companies that prioritize ESG principles are likely to outperform their competitors in the long run.

2. Technology and Innovation: The technology sector continues to be a hotbed of innovation and growth, with advancements in artificial intelligence, blockchain, and cybersecurity shaping the future of industries across the board. Investing in tech companies that are at the forefront of these innovations can offer lucrative returns for those who are willing to take on a bit of risk.

3. Healthcare and Biotech: The COVID-19 pandemic has highlighted the importance of healthcare and biotech companies in our society, and investors are taking notice. From pharmaceutical giants to biotech startups, there are plenty of opportunities to invest in companies that are working to improve healthcare outcomes and develop life-saving treatments.

4. Real Estate: Despite the challenges brought on by the pandemic, the real estate market remains a strong investment option for those looking to diversify their portfolios. From residential properties to commercial real estate, there are plenty of opportunities to generate passive income and build wealth over the long term.

5. Renewable Energy: As the world shifts towards a more sustainable future, investing in renewable energy sources such as solar, wind, and hydro power is becoming increasingly popular. With governments around the world committing to reducing carbon emissions, companies in the renewable energy sector are poised for significant growth in the coming years.

6. Emerging Markets: While established markets such as the US and Europe continue to attract investors, emerging markets in Asia, Africa, and Latin America are also garnering attention for their growth potential. Investing in these markets can offer higher returns, but it’s important to do thorough research and understand the risks involved.

7. Cryptocurrency and Blockchain: The rise of cryptocurrency and blockchain technology has revolutionized the way we think about money and transactions. While the volatility of the crypto market can be daunting, many investors are seeing the potential for significant returns by investing in digital assets such as Bitcoin and Ethereum.

8. Impact Investing: Impact investing focuses on generating positive social and environmental outcomes alongside financial returns. From affordable housing projects to sustainable agriculture initiatives, impact investing allows investors to make a difference while also making a profit.

By staying informed and proactive in monitoring these top investment trends, investors can position themselves for success in the year ahead. Whether you’re a seasoned investor or just starting out, keeping an eye on these key sectors can help you make informed decisions and maximize your returns in 2022 and beyond.

Top Investment Trends to Watch in the Coming Year